Technical Article

Value Stacking with Battery Energy Storage Systems

This is an article about grid-tied battery energy storage systems (BESS), but first, let’s rewind to 2007. At the time, Motorola, Nokia, and Blackberry were dominant players in the fast-growing mobile phone market, with exciting new features such as integrated cameras and QWERTY keyboards. Then came the first iPhone, and everything changed. From flip phones to touch screens, from Tetris to Angry Birds, from mailing checks to Apple Pay. Phones transformed from communication devices into powerful handheld tools that touched many aspects of our lives.

Much like how early smartphones unlocked a bevy of new features, functions, and markets, grid-tied BESS are undergoing a similar period of rapid value expansion. In the sections that follow, we will explain why today’s energy storage technologies are capable of providing far more than just backup power, and outline a few strategies to “value stack” your next project.

What is the value of energy resilience?

If early mobile phones were primarily designed to make calls or send text messages, early BESS were designed primarily for resilience, or the ability to serve loads with or without a grid connection.

Resilience, much like calling or texting, holds a lot of value. But quantifying that value is tricky, largely subjective, and often related to the financial impact of a severed grid connection. For example, a cold storage facility operator with millions of dollars of temperature-sensitive inventory may value energy resilience more than the average homeowner. To the facility owner, the value of resilience is tied to the value of lost inventory (and thus, lost revenue) from a power outage.

Energy resilience has always been, and will continue to be, a leading motivator behind BESS projects. But energy storage technologies and standards are innovating quickly, opening up many new cost-saving services and alternate revenue streams for system owners that go well beyond their subjective value of resilience. The term “value stacking” refers to the bundling of these services, and their positive impact on project returns.

How can I value stack an energy storage project?

Value stacking transforms a microgrid from a backup power system into a dynamic energy asset that provides financial and operational benefits. Let’s look at a few examples.

-

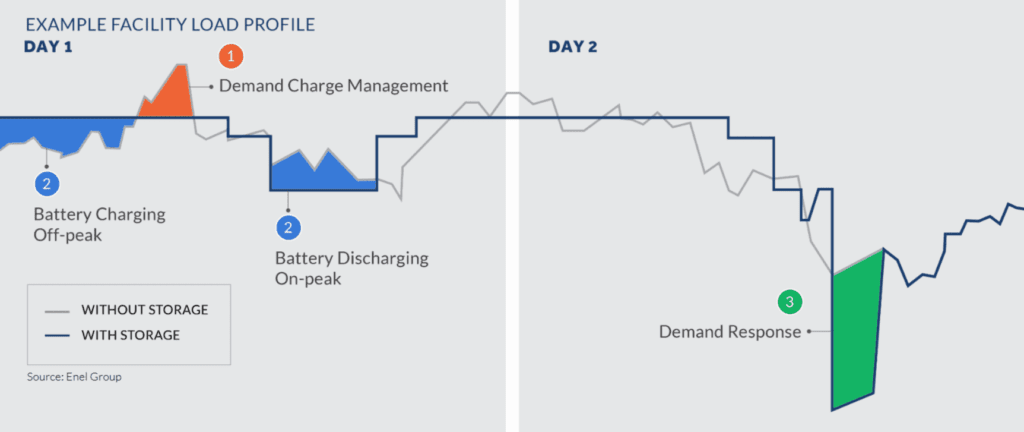

Demand Charge Reduction: If the utility rate structure has demand charges, the BESS can be used to replace electricity imported from the utility above a certain threshold to "shave" the facility's load "peaks." This reduces utility demand charges, resulting in bill savings.

-

Time-of-Use Arbitrage: If the utility rate structure has time-of-use (TOU) charges, the BESS can be programmed to charge from the grid when prices are low and discharge to the facility when prices are high. This results in utility bill savings.

-

PV Self-Consumption: In cases where exported PV production is not compensated at the same price as electricity purchased from the utility, retaining PV production for consumption on-site carries a financial benefit. A BESS can be used to charge from excess PV production, and later discharge to offset utility consumption.

-

Grid Services: BESS may provide important services to the grid, and in some cases this can carry financial benefit. Demand response, fast frequency response, and participation in aggregated virtual power plants (VPPs) are just a few examples. These types of opportunities vary geographically, and are related to either regional markets (ERCOT, PJM, etc.) or utility-specific programs and bilateral agreements.

-

Avoiding Utility Service Upgrades: On-site power generation and storage can help avoid costly and potentially lengthy utility service upgrades.

All of the above functions provide additional value for a project, but none of them happen in a vacuum. Mayfield can model the financial impacts of value stacking BESS, but, as the electrical engineer of record, we are just one piece of the puzzle. Value stacking involves significant coordination with project stakeholders, including (but not limited to) the local utility and the BESS and controls system manufacturers. For example, participation in some grid services programs, such as demand response, may require additional equipment and programming. It’s important to factor in the cost and time to research, program, and execute functions (and/or integrate additional equipment) that go beyond resilience.

How does value stacking impact project engineering?

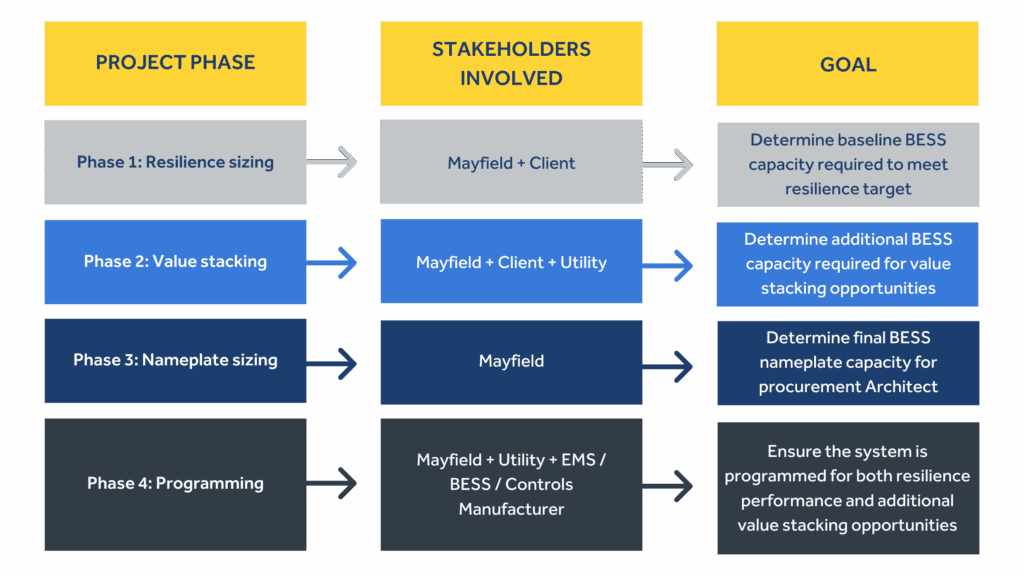

Mayfield follows a phased approach to BESS sizing as part of our feasibility study service. The table below presents a simplified, generalized description of our process. Note that the goals and stakeholders for each phase are subject to the specifics of each project.

Much of the process above is collaborative and involves thorough engagement with project stakeholders so they can decide the best path forward based on the options available. For example, for a given project, would it make financial sense to upsize the BESS to leave reserve capacity for demand response program participation? How do the utility’s demand response controls integrate with the onsite energy management system?

Once we’re into Phase 3 and all key decisions have been made by the client, we calculate the final BESS nameplate capacity. We like to present our feasibility study findings with intuitive visual aids, so our reports can be easily distributed and clearly understood by all key stakeholders. See one example of a BESS sizing visualization below.

Here, we visually demonstrate how the BESS setpoints may govern microgrid operation. In this example project, we have determined that a 650 kWh reserve is required for the facility owner to meet their minimum resilience performance goal. During normal grid-interactive operation, the BESS may perform grid services and act as an energy sink for PV self-consumption. There is a cumulative 150 kWh of battery capacity available for these economic functions, but the BESS may not use the resilience reserve for these purposes. Lastly, we account for the minimum and maximum states of charge (SOC) between which the BESS is designed to operate to maintain healthy performance. Together, the nameplate BESS energy capacity sizing for this project is 1,000 kWh.

By this point in the preliminary analysis, our clients understand the nameplate capacity and functionality required to select a particular BESS model for the project. Mayfield can also perform financial modeling to quantify the estimated return on investment from economic functions and guide decision-making.

Finally, once system design decisions are made, we can develop conceptual sequence of operations documentation for handoff to the energy management system (EMS) provider to program the system for both resilience performance and value stacking opportunities.

Mayfield Renewables provides design and engineering services for solar-plus-storage systems, and feasibility studies for microgrid systems. Contact us today for a consultation.